Paying bills on time, keeping a credit card balance low, and using a credit card responsibly help you gain the trust of lenders. So, rebuild credit history by improving your financial history. With smart financial habits and consistent effort, you can get access to different loan options, improve your credit score, and secure a stable financial future for yourself as well as your family.

Importance of Rebuilding Credit Score

Rebuilding a credit score is very important for your financial health, as it provides access to favorable loan and credit card terms. These terms include lower interest rates and higher credit limits, making borrowing easier and cheaper. Having a good score also improves your chances of getting approved for credit cards and loans. Thus, helping to apply for renting apartments or getting utilities, and sometimes reviewing an employee’s background. To get financial benefits, you can go through the following steps:

- Lower Interest Rates: A higher score indicates that you need to pay a lower interest rate for credit cards and loans. It then saves a significant amount of your money. For example, a small difference in the interest rate, say of only 1% can lead to savings over a 30-year mortgage. Thus, a lower interest rate indicates they you need to pay less in monthly payments, offering flexibility on your budget.

- Easy Credit and Loan Approval: Having a good credit score increases your chances of being approved for different credit types, including car loans, mortgages, as well as personal loans.

- High Credit Limits: Lenders often tend to provide higher credit limits on your credit cards if you have a good score. So, a higher limit also helps you reduce the credit utilization ratio, which then increases your credit score. Furthermore, a good credit score provides you with more options in case of emergencies. The lenders also see them as a sign that you are a low-risk customer who can manage your finances properly.

- Access to More Financial Options: You can get access to premium credit cards if you have a good credit score. This also opens the path for more financial products with better rewards and terms. Furthermore, some lenders even offer you a pre-approved and personalized offer for customers with strong credit points.

Credit Score Rebuilding Solutions

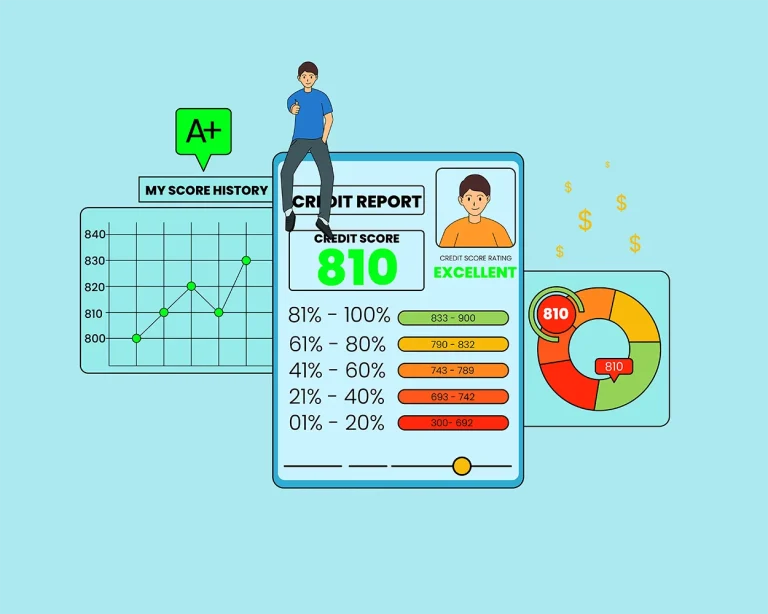

Credit score rebuilding consists of paying off debt on time, decreasing high-interest debt, and keeping credit utilization low, mainly less than 30%. You can also explore other options, such as checking and disputing errors on the credit report, keeping the old accounts intact, and limiting new credit applications carefully. So, if you are looking for bad credit solutions, you can go for the following options:

- Review Credit Reports for Errors: Get free copies of your credit reports from the three major bureaus are Experian, Equifax, and TransUnion. After that, check for inaccuracies such as accounts reported as closed, wrong personal details, or late payments that are actually paid on time. Furthermore, you can also dispute errors directly by taking the help of credit bureaus to have them fixed.

- Reducing Credit Card Balances: Try to keep your credit utilization ratio less than 30%. The credit utilization ratio is the amount of credit you are using relative to your total available credit. So, paying off all the existing balances can create a positive impact on your overall credit score. Furthermore, avoid closing old accounts, and keeping them on your ledger can help maintain a lower utilization ratio.

- Avoid Opening Too Many Accounts: Every time you apply for credit, an inquiry is made on your report, which reduces your credit score a little. Opening multiple accounts in a short period can appear risky to some lenders. Thus, apply for a new one only when needed and after exploring other options.

- Seeking Credit Counseling: The nonprofit credit counseling provides the right guidance on managing debt and improving your credit. They can also help you negotiate with the creditors, create a budget, and create a plan to pay off the debt. Furthermore, to do this, you can take the help of the Financial Counseling Association of America (FCAA) or the National Foundation for Credit Counseling (NFCC).

Understanding Credit Card Situations

Before you start to rebuild your credit score, it is important to understand your current credit situation. Knowing your credit score helps you find out the problem areas, avoid repeated mistakes, and develop a clear plan to improve your score. Therefore, by taking a detailed look at your credit report, payment patterns, and debt, you can make smart financial decisions. You can understand your credit card situation by following these steps:

- Check for Fraudulent Activities and Errors: Errors on credit reports are too common these days. Incorrect balances, duplicate accounts, or unfamiliar accounts can indicate errors or even theft. Therefore, disputing these inaccuracies with the help of credit bureaus can eliminate them and improve your score.

- Analyzing Debt-to-Income Ratio: Learning about your debt relative to your income offers proper financial insights. A high debt-to-income ratio might decrease your chances of taking out a new credit. Thus, start by decreasing high-interest debts to save up more money and improve credit management.

- Reviewing Payment History Patterns: Review your past payment habits to understand all your recurring financial issues. If you missed the due dates on some accounts, such as personal loans or credit cards, you need to identify the patterns to implement solutions like budgeting strategies or automatic payments.

Diversifying Credit Accounts

Diversifying credit accounts consists of the combination of different credit types. These types include revolving credit (credit card) and installment loans, to show lenders that you can handle your finances properly. Such a combination helps you increase your credit score, but it can be done over time, and avoid opening multiple accounts. Opening multiple accounts at a time appears as a red flag to many lenders. Therefore, having a diversified credit history appears as a positive point to the lenders. However, these are less influential than other factors like credit utilization and payment history.

What are the types of credit accounts?

- Revolving Credit: Revolving credit generally offers you flexible access to money. This credit helps you to borrow the set credit limit, then repay the amount you use, and borrow again in the future. Credit cards are the best example of revolving credit. If you manage to make payments on time while keeping the balance low, it increases your credit score. Furthermore, revolving credit generally doesn’t end after a certain period; you can use more if you stay within the set limit. Thus, it offers you the freedom to manage all your daily expenses, create a credit history, and handle emergencies.

- Installment Credit: Installment credit allows you to borrow a fixed amount and repay it within a fixed period in every monthly cycle. The most common examples include car loans, mortgages, and personal loans. In installment credit, the terms are very clear from the start, making it easy to plan the budget. Furthermore, if you clear all payments on time, it keeps your credit score intact and shows lenders that you can manage your finances better. Thus, it is considered the best way to create a strong credit history.

Conclusion

Rebuilding credit history often takes time, the right strategies, and discipline. So, by decreasing balances, paying bills on time, and diversifying credit types, you can make a strong credit score. Smart credit habits boost the trust of the lenders, unlock better loan options, and develop a secure financial foundation.