When you want to be free with your money, you need to have good credit. But a lot of people want to know what credit score they should start with. Some people might be wondering how to fix their credit if they’ve experienced money troubles in the past.

This blog will explain how credit scores start, what affects your score at first, and most importantly, how you may rebuild your credit. We’ll show you how to repair your credit history and establish a better financial future step by step.

What is a credit score?

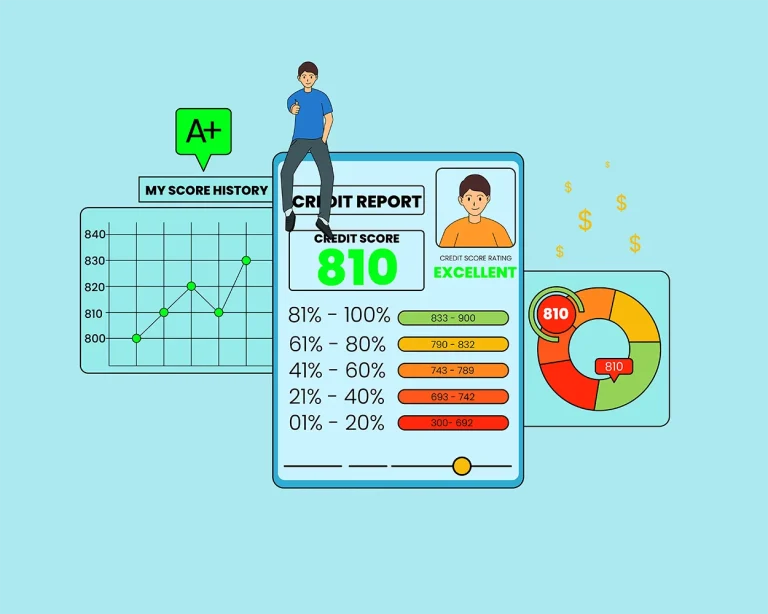

A credit score is a number that shows how good you handle borrowing money. This tells the lenders that what you are outstanding is likely to be paid back. Credit points usually range from 300 to 850. The most common types are FICO and VantageScore. A high score means you have better credit, so it’s easy to get loans, credit cards, and low interest rates.

What credit score do you start with?

Here, some such people do not know: You do not start with a credit score.

After opening your first credit account as a credit card, student loan, or car loan, you only get one credit score. After that, the lender shares your account activity with the credit reporting companies. Then these companies begin to build your credit history and give you a score.

What will be your first credit score?

It depends on how to use your credit. Most of the first credit points come between 500 and 700.

If you:

- Pay your bills on time,

- Keep your credit card balance low,

- Do not apply for many credit accounts at a time.

- You can start with a high score.

However, if you remember the payment or use too much credit, your score can start to decline.

Why do people need to rebuild their credit history?

Sometimes, even cautious people have problems with money. Losing jobs, high medical bills, divorces, or not knowing how credit works.

Can guide these issues: missing payment, unpaid loan, loan sent for collection, and bankruptcy. All of them are damaging your credit points. But the good news is that you can rebuild your credit and improve your financial future.

How to rebuild credit history: Step-for-Step Guide

Whether you start fresh or fix previous errors, you can rebuild your credit with the right steps. This way:

1. Check your credit report

First, see your credit report. You can receive a free report from each credit reporting company each year.

Check for:

- Incorrect account information

- Any sign of fraud or identity theft

- Old accounts that are no longer to be listed

If you see incorrectly, you must submit a dispute. Even a late payment can damage your credit scores.

2. Pay all bills on time

Your payment history is very important. This makes 35% of your credit points.

To stay on track:

- Enter automatic payment for minimal minimum payment

- Use a telephone or bank reminder for fixed dates

- Mark payment dates on a calendar

- Even a payment can slow down your progress.

3. Use a safe credit card

A safe credit card helps you rebuild credit quickly. You pay a deposit (usually $ 200 to $ 500), and it will be your credit limit.

- Use the card with care:

- Use small amounts

- Paying the full balance every month

- Keep the use below the 30% limit

If you use the card well, the company can upgrade you to a regular card, and your credit points will increase over time.

4. Keep the use of credit low

Credit use (also known as credit utilization) means how much you use your available credit. This affects 30% of your credit points.

To help your score:

- Keep your balance below 30% of your credit limit

- For best results, try to be less than 10%

- For example, if your card limit is $ 1000, try not to spend more than $ 100.

5. Don’t search for too much credit at a time

When applying for a new credit, lenders examine your report with a tough inquiry. Very difficult checks in a short time can reduce your score.

To protect your credit while reconstructing:

- Search only for credit when you need it

- Wait a few months between applications

- Try a tool before default — they use soft checks and do not damage your score

6. Try credit builder loans or accounts

Credit builder loans are small loans that help you improve your credit. Here’s how they work:

- You make monthly payments on a closed savings account

- When you finish your payment, you get money

- Your payment tells the story, which helps you make your score

Many new online tools also offer credit builder accounts that work in the same way, without traditional loan requirements.

7. Become an Authorized User

You can ask a reliable friend or family member to add your credit card as an authorized user. If they have a good payment history and the balance is low, it can help your score, even if you do not use the card.

Make sure the motherboard holder:

- Pays on time

- Keeps your credit balance low

8. Keep old accounts open

The longer your credit history, the better your score. If you close old accounts, you can lose:

- Credit historical length

- Available credit limit

If the old account does not have an annual fee, it is better to keep it open. This helps your credit grow rapidly.

9. Track your Credit Promotion

Always keep an eye on your credit. You can use:

- Free credit tracking apps

- Notice from the bank or card company

- Monthly score update from your credit account

Tracking your score helps you to be motivated and fix problems quickly.

How Long Does It Take to Rebuild Credit History?

It takes time to rebuild your credit, and it depends on how bad the loss is. If you had delayed payment, you can see improvement in 3 to 6 months. If you pay the collection, it can take 6 to 9 months. Bankruptcy takes longer, usually 12 to 24 months or more. If you are new to credit, you can see progress in 3 to 6 months. Getting help from credit counseling in Flagstaff, AZ, can guide you in the right direction. By paying timely, using low credit, and following good habits, many begin to see better credit in 6 to 12 months. Be patient and continue working towards better credit each month.

Where your credit starts

Your credit does not start with a score. This begins when you open your first credit account, such as a credit card, student loans, or car loans. When you use and pay the account, the lender reports activity to credit reporting companies. After a few months, you get your first credit score. This score usually comes between 500 and 700, depending on how you manage your credit.

To make good credit quickly, make sure you pay the bills on time. Just try to use a small part of your credit limit and avoid applying for many new accounts at the same time. These simple habits help you create a strong credit story and prepare for a better financial future.

How to make it back strong

If you have had credit problems lately, you can fix them with the right steps. Start by checking your credit report for errors. If you find errors, you must dispute them immediately. Then use accessories such as safe credit cards or credit builder loans to improve your credit points over time.

You can also ask a reliable friend or family member to add you as an authorized user to a well-managed credit account. If they do not require any fee, try keeping the old accounts open, as they help show a long credit history. Be sure to check your credit regularly so you can track your progress and stay on top of any changes.

Final Thoughts

You may not start with a credit score, but you can control how your credit grows. Whether you’re new to credit or fixing past mistakes, you can rebuild your credit history by starting small, staying consistent, and not giving up.

Remember, building good credit isn’t about being perfect. It’s about making progress. Every time you pay a bill on time, use credit wisely, or make a smart money choice, you move closer to a strong and healthy credit history.