Our credit score is like a financial passport. It means you qualify for better loans, lower interest rates and more money. When you apply for a home loan, car loan, or a new credit card, lenders consider your credit score. You’re showing them that you’re a responsible borrower if you have a high score.

But low credit scores plague many people. This can make it difficult to qualify for a loan or find good rates. Credit score services help you repair credit problems and boost your score. They give you step-by-step help so you can qualify for better loan offers and reach your money goals faster.

Understanding the Credit Score: The Foundation of Loan Approval

Before we get into the ways in which these services can be of assistance, it is very useful to define what a credit score is and why it is important.

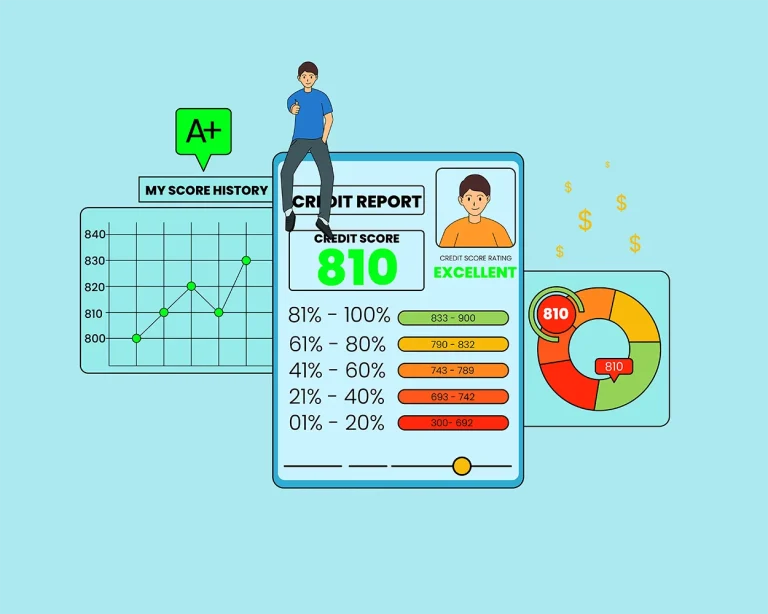

What is a Credit Score?

A credit score is a three-digit number generally ranging from 300 to 850 which shows the likelihood that you will repay money that you borrow. Lenders rely on it to determine whether to give you a loan or credit card. Your score is determined by the way you pay bills, how much credit you use, how long you’ve had credit, what new credit checks you have, and the kinds of credit you use. The higher the score, the lower the risk for lenders, so maintaining a high score makes it easier to receive better loan and credit offers.

Why Is a High Credit Score Important for Loans?

Lenders check your credit score to decide:

- If they will approve your loan

- What interest rate to offer you

- How much money you can borrow

- What terms and conditions to include in the loan

Your credit score affects your loans:

- Having a credit score of 700 or more can help you qualify for the lowest APRs and expedited loan approvals.

- Those under 700 can restrict your borrowing options and force you to pay more in interest.

- Even dipping under the 600 mark can make approval difficult and may negatively impact the individual’s eligibility without the help of a co-signer.

Overall, a low credit score limits your borrowing options and drives up the cost of borrowing.

What Is a Credit Score Enhancement Service?

A credit score improvement service is a service that assists you in correcting errors in your credit score. Their mission is to add some polish to your credit image so you can be approved more easily for loans. They do this by assisting you in fixing your mistakes, organizing your finances and providing you with the right advice.

Main Services They Offer:

1. Credit Report Check

- They look at your credit reports from the big credit bureaus.

- They find mistakes or old info that may be hurting your credit score.

2. Fixing Credit Report Errors

- They help you send letters to the credit bureaus to correct wrong info like late payments or accounts that don’t belong to you.

3. Help With Debt

- They give you a plan to pay off your debts in a smart way. This can lower your credit card use and boost your credit score.

4. Rebuilding Your Credit

- They give tips on how to build your credit again. For example, they may suggest using a secured credit card or becoming an authorized user on someone else’s card.

5. Credit Monitoring and Support

- They keep an eye on your credit and tell you when something changes. They also update your plan so you can keep making progress.

Using these services can help you fix your credit faster. You’ll also learn how to manage your money better and improve your chances of getting approved for loans, credit cards, or even a house.

How a Credit Score Improvement Service Helps You Get Better Loans

A credit score improvement service helps boost your credit score so you can qualify for better loan offers. Here’s how they do it:

1. Fixing Credit Report Mistakes

Many credit reports have errors. In fact, a study from the FTC shows that 1 in 5 people has a mistake that could hurt their score. Common errors include:

- Late payments that aren’t real

- Closed accounts listed as still open

- Old negative marks that should be gone

- Debts that don’t belong to you

The service looks through your credit reports carefully. Then, they help you fix these mistakes by sending disputes. This can quickly raise your score.

2. Lowering Your Credit Card Use

Using too much of your credit limit (over 30%) can lower your score. Credit improvement services give you tips to lower that usage. They help you:

- Pay off the right cards first

- Combine debts through consolidation

- Request higher credit limits in order to decrease your usage percentage.

These measures can also help enhance your debt-to-income ratio, which lenders look at before issuing you a loan.

3. Improving Your Credit Profile

Lenders want to see a mix of different types of credit and a long history.

- Opening new types of accounts, like a credit card or a small loan

- Becoming an authorized user on a trusted person’s card

- Keeping old accounts open to make your credit history longer

These actions make you look more experienced and trustworthy to lenders.

4. Helping You Make On-Time Payments

On-time payments are the biggest factor in your credit score. Credit improvement services help you stay on track by:

- Sending payment reminders

- Giving you helpful tools

- Offering one-on-one coaching

When you pay on time every month, your score can go up by several points in just a few months.

5. Getting You Ready for a Loan

Some services also help you get ready to apply for a loan. They look at your credit and tell you:

- The best time to apply

- What interest rates you might get

- What you need to do.

This simplifies getting a loan and makes you profitable to lenders.

Advantages of Using a Credit Score Improvement Service

- Faster Score Improvement

You can raise your score more quickly with professional assistance. That way you can qualify at an earlier date for things like home loans, car loans or personal loans. - Professional Error Disputes

Credit experts find and fix errors on your credit report. As a result, your score can go up quickly. - Personalized Financial Guidance

These services give you advice based on your personal credit situation. This helps you take the right steps to improve your score. - Better Interest Rates

A higher credit score helps you get lower interest rates. This way, you can save money on your loans and credit cards. - Improved Financial Habits

You get tools and tips to manage your money better. Over time, this helps you stay on track and keep a good credit score. - Fewer Loan Rejections

When your credit improves, lenders are more likely to say yes. This lowers your chances of getting denied for loans. - Access to Better Credit Products

With a better score, you can get higher credit limits, better credit cards, and special loan offers.

What to Look for in a Credit Score Improvement Service

Not every credit repair company is reliable. Choosing the right one helps you avoid scams and actually improve your credit. Here’s what to look for:

- Transparency in Pricing

Choose a company that clearly shows all costs upfront. Stay away from companies that hide fees or try to sell you extra services you don’t need. - No “Quick-Fix” Guarantees

Avoid companies that promise fast results or overnight fixes. Improving your credit takes time and real effort. Honest services focus on long-term success, not quick tricks. - Proper Accreditation

Find a company that is a member of respected organizations such as the National Association of Credit Services Organizations (NACSO). This means that they adhere to rules and professional standards. - Good Reviews and Customer Testimonials

Read through reviews on trustworthy sites such as Google, Trustpilot or the Better Business Bureau (BBB). Positive reviews are an indication that customers experienced successful results and felt they were supported.

- Clear Cancellation Policy

Ensure the company allows you to cancel at any time and explains how that process works. Steer clear of companies that put up roadblocks to canceling or levy unfair fees.

For reliable assistance from a service that offers credit counseling in Flagstaff, AZ residents can count on expert advice and local support to navigate the credit repair process.

Final Thoughts

Don’t let your credit score prevent you from getting better loans. With the proper assistance, you can make your credit score a strong asset. A Credit Score Improvement Service guide you by providing professional advice, clear plans, and actionable targets for improving your credit.

As you raise your credit score, better loan products open up, you feel less financial stress and have more control over your money. Whether you want to buy a home, get a car loan or even start a business, maintaining good credit is a wise decision.