Your credit score isn’t just a number, it’s a powerful tool that affects many parts of your life. In today’s world, and especially as we head into 2025, your credit score can help you get approved for loans, rent an apartment, or even get hired for a job.

That’s why it’s more important than ever to know what counts as a good credit score and how to build or keep one.

In this easy-to-follow guide, we’ll break down what a good credit score looks like in 2025, why it matters, and simple steps you can take to improve or maintain yours.

What Is a Credit Score?

A credit score is a three-digit number that shows how likely you are to repay borrowed money. Lenders use it to decide whether to approve you for credit, like loans or credit cards.

Your score comes from your credit report, which includes details like your payment history, how much you owe, how long you’ve had credit, the types of credit you use, and any recent applications for new credit.

While there are different scoring models, most lenders in 2025 still rely on FICO Score and VantageScore. Both scores range from 300 to 850. The higher your score, the lower the risk you pose to lenders.

What Is a Good Credit Score in 2025?

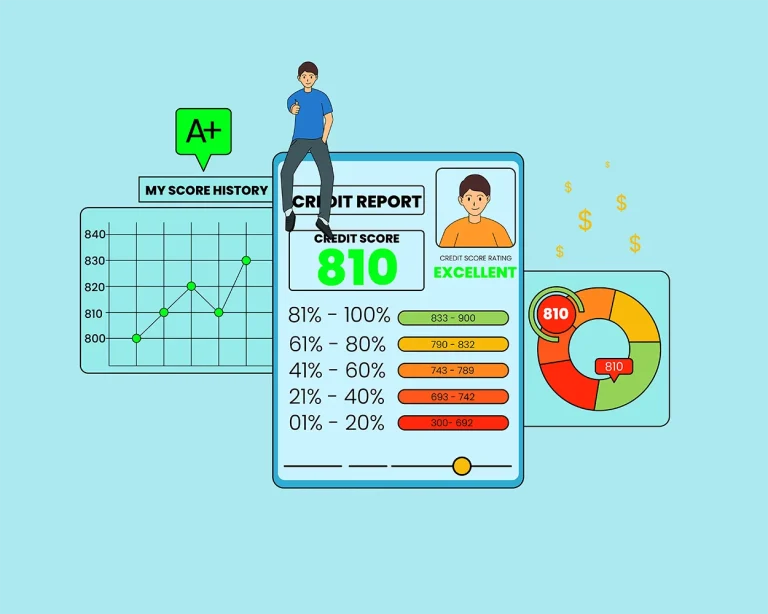

In 2025, a credit score of 670 or higher is considered good. Here’s a quick breakdown:

- 800–850: Excellent – You’ll get the best interest rates and offers because lenders see you as a low-risk borrower.

- 740–799: Very Good – You’ll still qualify for great rates, and lenders will trust you.

- 670–739: Good – You can get favorable loan terms, but not the best rates available.

- 580–669: Fair – You might face higher interest rates, and some lenders could be more cautious about approving you.

- 300–579: Poor – You may struggle to get approved for loans or credit cards, and if you do, the terms won’t be favorable.

Having a good credit score (670+) opens the door to better interest rates, lower insurance premiums, and more financial opportunities. It also gives you greater control over your finances and access to higher credit limits or larger loans.

Why Is a Good Credit Score Important?

A good credit score does more than help you get approved for loans. It also improves many other parts of your financial life. Here’s how:

Lower Interest Rates

With a good credit score, lenders trust you more. As a result, they offer lower interest rates on credit cards, car loans, and mortgages. This can save you thousands of dollars over time.

Higher Credit Limits

When you manage credit well, lenders feel confident giving you higher limits. This gives you more spending power and helps keep your credit utilization low, which can boost your score even more.

Better Insurance Rates

Many insurance companies check your credit to help set your rates. A higher score can lead to lower monthly payments for car, home, or renters’ insurance.

More Rental and Job Opportunities

Landlords often check credit to see if you’ll pay rent on time. Some employers, especially in finance or government, also review credit reports. A good score can help you get approved for a rental or stand out in a job search.

How Is a Credit Score Calculated?

Knowing what affects your credit score can help you take steps to improve it. The FICO score uses five main factors:

1. Payment History (35%)

First and most importantly, pay your bills on time. Late or missed payments hurt your score the most.

2. Credit Utilization (30%)

Next, keep your credit card balances low compared to your limits. Using too much credit can lower your score.

3. Length of Credit History (15%)

Then, consider how long you’ve had your accounts. Older accounts show a longer, more stable credit history.

4. Credit Mix (10%)

Also, use different types of credit—like credit cards, auto loans, or mortgages. A mix shows you can handle various kinds of debt.

5. New Credit (10%)

Finally, be careful about opening too many new accounts at once. Too many recent credit checks can raise red flags.

How to Achieve a Good Credit Score in 2025

If your credit score isn’t where you want it to be, don’t worry. You can take simple steps to boost it. Here’s how:

1. Pay Your Bills on Time

Start by paying all your bills on time. Since payment history has the biggest impact on your score, set reminders or use automatic payments to stay on track.

2. Lower Your Credit Card Balances

Next, try to keep your credit card balances below 30% of your limit. For example, if your limit is $10,000, aim to keep your balance under $3,000.

3. Limit New Credit Applications

Also, avoid applying for too many new credit accounts. Each application adds a credit inquiry, which can temporarily lower your score.

4. Keep Old Accounts Open

Then, hold on to your older credit accounts. Longer credit history helps your score, so only close accounts if you really need to.

5. Use Different Types of Credit

Finally, mix it up. Using both credit cards and loans shows lenders you can handle different types of credit responsibly.

How Long Does It Take to Improve a Credit Score?

Raising your credit score takes time, it doesn’t happen right away. Depending on your situation, it might take a few months to over a year to see big changes. If your score dropped because of missed payments or high credit card balances, it may take longer to recover.

On the bright side, you can see small improvements in 30 to 60 days if you pay down your debt or fix errors on your credit report. But if you’re dealing with serious issues like collections or bankruptcy, rebuilding your credit could take several years.

To keep moving forward, stay consistent. Pay your bills on time, keep your balances low, and limit new credit applications. Also, check your credit report often so you can track your progress and catch any mistakes early.

Common Credit Score Myths Debunked

Myth 1: Checking My Own Credit Lowers It

Fact: This isn’t true. When you check your own credit score or report, it creates a soft inquiry, which doesn’t hurt your score. Only hard inquiries—like when a lender checks your credit for a loan or credit card—can slightly lower it. So, go ahead and check your credit regularly. It helps you stay informed and catch any problems early.

Myth 2: You Need to Carry a Balance to Build Credit

Fact: You don’t need to keep a balance or pay interest to build credit. In fact, carrying a balance costs you money. Instead, use your credit card and pay the full balance each month. This shows lenders you can manage credit well without falling into debt.

Myth 3: Closing Credit Cards Improves Your Score

Fact: Closing a credit card can actually lower your score. It reduces your available credit and can increase your credit utilization. Also, closing older cards shortens your credit history, which can hurt your score. If you don’t use a card often, keep it open and use it occasionally to keep the account active.

When to Seek Professional Help

If managing debt feels overwhelming or confusing, it might be time to get expert support. A credit score improvement service can guide you with a personalized plan, help you fix errors, and create smart strategies to improve your score. These services work especially well if you have a complicated credit history or want faster results.

The Future of Credit Scoring in 2025

In 2025, credit scoring is becoming more inclusive and data-driven. Now, some scoring models include alternative data, such as rent, utility, and subscription payments. Fintech platforms and mobile apps also offer real-time tracking, alerts, and AI-driven tips to help you make smarter credit choices.

Furthermore, lenders are using open banking and AI to evaluate creditworthiness beyond traditional methods. As a result, maintaining good overall financial habits—not just focusing on credit cards, will become even more important.

End Note

In 2025, building and keeping a good credit score is a smart move toward financial freedom. Whether you want to buy a home, launch a business, or enjoy better financial choices, your credit score matters a lot.

First, check your current score so you know where you stand. Then, take clear steps to improve your credit habits, like paying bills on time and lowering debt. If things feel overwhelming, ask a financial expert for help. With steady effort and patience, you can build a strong credit score and open new doors.