When financial obligations become oppressive, you can not see a clear path, which leads to a stressful life. If you are struggling to repay your debt and make ends meet, expert credit counseling in Flagstaff, AZ could be a game-changer.

Professional credit counselors work with people who face financial hardship, helping to consolidate debts, create manageable financial plans, and negotiate better repayment terms. Let us explore what credit counseling is and how it assists you in achieving a strong financial status.

What Exactly is Credit Counseling?

Credit counseling is a professional service that is designed to help people manage their finances and improve their credit scores. Generally, it is offered by non-profit agencies to educate and guide debtors on their financial issues. For decades, this concept has been around to help many individuals rebalance their financial lives.

This service is not only aimed at supporting you in controlling money but also offering you peace of mind.

Working Process of a Credit Counselor

Credit counseling begins with an initial consultation performed by a certified credit counselor. They assess your financial conditions, like income, debts, expenses, and credit report. Based on the review, they create a customised financial plan that could meet your needs. From building debt management strategies to budgeting advice and suggestions for improving your credit score, the plan includes all. Steps involved in the counselling process are formed to offer comprehensive support to individuals in achieving financial stability.

Necessity of Getting Expert Credit Counseling

Managing debt can feel overwhelming, especially when payments, penalties, and interest rates escalate. Taking an expert credit counseling service helps you regain financial stability with practical debt solutions and expert guidance. Here is why it is needed:

A. Personalized Financial Guidance

We all have unique financial situations. That’s why a credit counselor is needed who observes your specific requirements and builds customized repayment strategies, ensuring you will receive realistic results.

B. Debt Management Plans

Counselors create a debt management plan to merge multiple debts into a single EMI schedule with a generally reduced interest rate. This results in a simple payment process, making your debt free quickly.

C. Saving from Bankruptcy

For many debtors, counseling provides a bankruptcy alternative. Such professionals can save you from severe credit damage by restructuring debt and developing financial habits.

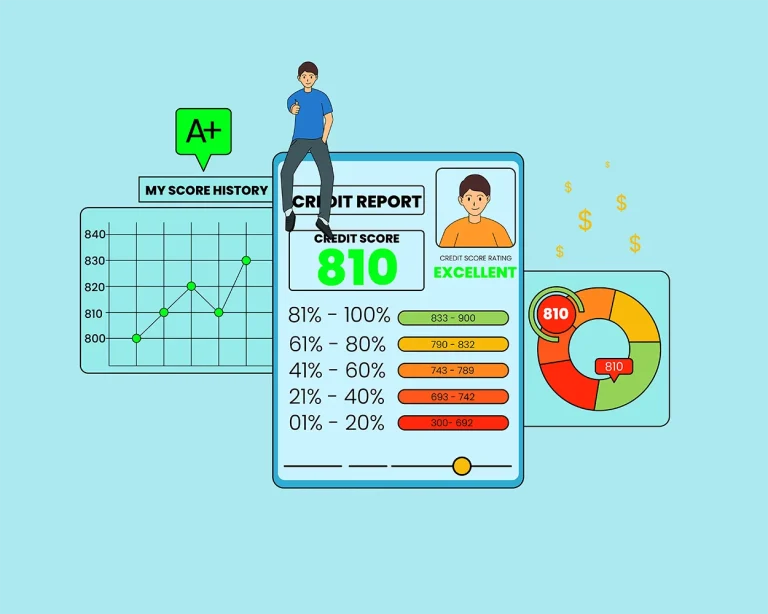

D. Credit Education

It is also essential for you to know the working process of a credit score. Expert counselors guide about responsible credit use and how to maintain a strong credit score.

E. Stress-free life

A credit counsellor shows you a path to regain your financial control. This helps you to improve your financial declination position and live a peaceful life again.

Benefits of Credit Counseling in Flagstaff

Flagstaff residents deal with unique economic challenges, including student loans, home loans, and rising living expenses. This is where expert credit counseling in Flagstaff, AZ comes to help them. Local counsellor has expertise in offering reliable solutions for residents to regain financial stability. If you live in this city and face a similar issue, here is how professional credit counseling is valuable:

A. Local Expertise

Credit counselors in Flagstaff have a deep knowledge of the local financial environment. They can connect you with state-funded resources, valuable community programs, and debt relief initiatives specific to the city. This local insight helps you to receive practical, relevant guidance customized to your financial condition and goals.

B. Long-Term Solutions

With credit counseling, you not only fix financial issues temporarily, but also receive sustainable habits and long-term financial stability. Local counsellors help you analyse your spending patterns, enhance money management skills, and develop strategic plans to save from future debt. This proactive approach builds lasting financial stability and confidence, beyond debt relief.

C. Affordable Services

Most credit counseling agencies in Flagstaff offer low-cost or free bad credit solutions to individuals to make them accessible to everyone. Such affordable services help individuals get expert financial advice and create manageable budgets. They also find debt repayment options without going through financial pressure or hidden costs.

D. Confidentiality

Local counselors provide opportunities where you can discuss your sensitive financial matters without fear or embarrassment, keeping counseling sessions private. They maintain strict privacy and offer a supportive, judgment-free space. Here, you could openly address financial issues and work toward achievable solutions with trust and respect.

Signs Showing You Need Credit Counseling

Many people delay seeking financial help until their debt becomes oppressive. However, taking credit counseling early can take a big step in regaining financial control. Here are the common signs that you need a professional credit counseling service:

- You are living a paycheck-to-paycheck life with little or no savings, making it hard to deal with emergencies or unexpected expenses.

- When you use credit cards to meet basic needs like groceries and bills, it shows that your income is not enough to cover everyday living costs.

- Situation where you struggle to make the minimum payments on time, making it too tough to reduce debt or maintain a healthy credit score.

- When you receive frequent calls or letters from collection agencies, it shows overdue accounts and potential credit damage.

- You feel anxious or stressed about money matters, which affects your emotional and physical well-being

If you experience any of these signs you experience, consult a certified counselor who can create a realistic budget and give expert guidance to get you back on track.

Bottom Line

A credit counseling service can be a lifeline for those struggling with debt by offering structured repayment plans. With expert credit counseling in Flagstaff, AZ, you can deal with financial challenges, improve your credit score, and live a peaceful life again.

If you’re ready to take the first step toward stability, reach out to Elevating Commerce Solutions. Our professionals provide customised solutions and guidance to address your unique financial challenges. Contact us today and achieve long-term financial health!