If you have ignored a vehicle loan or to worry about losing your car, it is important to understand how the renewal affects your credit. Repair can damage the credit score and make it difficult to borrow cash in fate.

In this easily read blog post we will explain the whole thing you need to feel about repetition. First of all, you will learn to stay on the credit record for a long time. Then we will show you how it reduces your credit points. The most important thing is that we will give you easy steps to fix credit and rebuild finance.

What is resonance?

Repetition occurs, while a lender takes a little less reception with a loan – usually a vehicle, due to the fact that you have not paid yourself on time. This is usually accompanied by safe loans, where the item (cheap -like) is used as an insurance for the mortgage loan. If you stop paying, the lender can legally pull the car.

There are two main types of revival:

- Volunteer rejuvenation: You take out the lender again to offer cars before you come to take it. In this way, you can avoid more expenses such as Toking or Garage expenses. In addition, it usually causes very little stress and causes very little damage to your credit points compared to a compulsion.

- Involuntary repetition: The lender sends someone to take a car without your help. As a final result, you can withstand several prices with two and a garage. In addition, it often causes more damage to your credit if you voluntarily returned the car.

It does not matter that the way it happens, the restoration can damage your credit points poorly and remain in your credit file for many years.

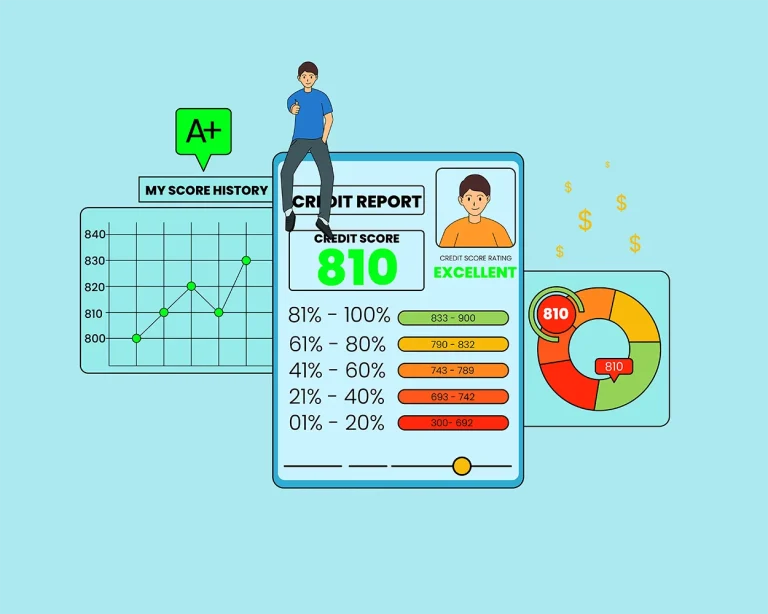

A regeneration remains in your credit point report for 7 years. This reverse number starts with the first missing payment, not from the date when the lender took the car.

Let’s clean it:

If you ignored your payment in January 2022 and took the car in June 2022, the 7-IR period still begins in January 2022.

Therefore, through January 2029, repetition can leave the credit score record, even though the lender took the car.

This rule applies to both voluntary and involuntary repetition.

How you can affect your credit scores

Repair can seriously damage the credit rating. This is how it affects character by character:

1. Delay

The lender takes your car, they usually archive your account as an overdose of 30, 60 or 90 days. This earlier reason pays to reduce the credit rating in advance.

2. Charge

If the lender comes to the decision to stop trying to deposit the loan after taking the vehicle, they will rank the loan. A cost-off item for your credit score file for 7 years and causes more damage to your review.

3. Collection

If you continue to pay cash after the car is purchased (it is called “lack of balance”), the lender will probably send the loan to a fundraising company. This makes everyone else bad touches on your credit score document.

4. Court decision

Sometimes the lender can also sue you for unpaid balance. If a court can lead to the guidelines for guidelines against you, it may be a decision. Most credit agencies do not show civilian decisions, although this is a significant problem.

Can you remove a repetition from your credit report?

It is difficult to throw off an actual rehearsal from the credit record before 7 years skips. But here are some ways that will help:

1. Check for errors

Look at the credit point record carefully. Somemes shows the wrong data such as the wrong date, wrong balance or even debt that is yours. If you notice an error, you can report a dispute with the Credit Score Bureau to repair it.

2. Talk to the lender

You can try to ask the lender to dispose of the repetition if you match pay what you are. It is known as “Payment for Deletion”. But keep in mind, most lenders and credit score agencies do not accept this.

3. Use a Credit Repair Service

Credit restore businesses let you discover mistakes and send disputes. They can’t delete a actual repossession, however they may cast off any wrong or harmful info related to it.

How to Rebuild Your Credit After a Repossession

An automobile repossession is serious, but you may nevertheless fix your credit. Follow these simple steps to rebuild your credit score:

1. Pay What You Still Owe

If you continue to owe cash after the repossession, try to pay it off or make a settlement. This won’t dispose of the repossession from your credit score record, but it will display which you paid your debt. Lenders will see this as an excellent sign.

2. Always Pay Your Bills on Time

Your price records affect your credit score the maximum. Set up reminders or automated payments to make sure you in no way miss a due date.

3. Get a Secured Credit Card

A secured credit card is simpler to get as it makes use of a coin deposit. Use the cardboard for small purchases and pay it off each month to construct a correct credit score.

4. Become an Authorized User

Ask a family member or pal with a desirable credit score to feature you as an authorized user on their credit card. Their on-time bills can assist your credit rating grow.

5. Check Your Credit Often

Use free credit score monitoring equipment to music your rating and fasten any mistakes. Watching your credit score allows you to live on target and reach your dreams quicker.

Will a Repossession Affect My Ability to Get a Loan?

A car repossession can hurt your credit, specifically in the quick term. It could make it harder to get authorized for new credit or loans.

- Auto creditors might nonetheless give you a loan, but they may ask for a larger down fee or rate a higher hobby rate.

- If you want to buy a house, mortgage creditors might see you as a volatile borrower. You may additionally want to attend 2 to three years and show proper cash habits earlier than they approve of you.

- Also, credit card companies might not provide you ordinary (unsecured) cards right away. Instead, you may want to start with a secured credit card that calls for a deposit.

- When it involves personal loans, lenders would possibly allow you to borrow much less or rate you greater interest until your credit score improves.

The appropriate news is, the damage doesn’t close all the time. If you begin paying bills on time, decrease your debt, and use credit score accurately, your rating can improve.

In reality, a few human beings see huge upgrades in 12 to 18 months. Most human beings qualify for better credit after 2 to three years of true habits. If you’re struggling with your credit after a repossession, credit counseling in Flagstaff, AZ can help you get back on track and build better financial habits.

Can a Repossession Be Reinstated or Canceled?

Yes, in a few cases, you may stop a repossession or get your car again. It relies upon your state’s legal guidelines and your lender’s regulations.

You have two principal alternatives:

- Reinstatement: You pay all of the overlooked bills, overdue costs, and any extra fees. This brings your mortgage current and helps you to get your car again.

- Redemption: You repay the entire loan stability. After that, you can lower back your automobile.

Act rapid, even though. These alternatives are most effective available for a short time, typically before the lender sells your automobile at public sale.

How to Avoid Car Repossession

You can avoid repossession by coping with your cash wisely. Here are some easy steps to help:

1. Talk to Your Lender Early

If you’re falling behind on payments, call your lender properly. They may additionally provide alternatives like a price plan, a quick spoil (forbearance), or a loan exchange to help you trap up.

2. Refinance the Loan

If your monthly fee is too excessive, attempt refinancing your mortgage. This may want to decrease your payment or provide you with more time to pay it off.

3. Sell the Car

If you don’t have the funds for the payments, it’s better to promote the auto and repay the loan than permit it to get repossessed.

4. Make a Smart Budget

Look at your earnings and spending every month. Make positive you have enough cash for your bills and loans. Avoid taking on greater debt than you can deal with.

End Note

A vehicle repossession can feel like a massive setback, however it does not close forever. It stays in your credit report for 7 years, however you may begin fixing your credit score much sooner. To rebuild consciousness on true credit score habits. Pay your payments on time, preserve your money owed low, and use unique styles of credit responsibly. As you stay steady, creditors will start to consider you once more. Over time, you’ll be in a miles higher vicinity financially.